- minute read

- minute read

As energy prices continue to soar, gas and electricity remain one of the biggest annual costs for UK families. It makes sense then that people are looking for ways to cut back in an attempt to try and save money on energy bills.

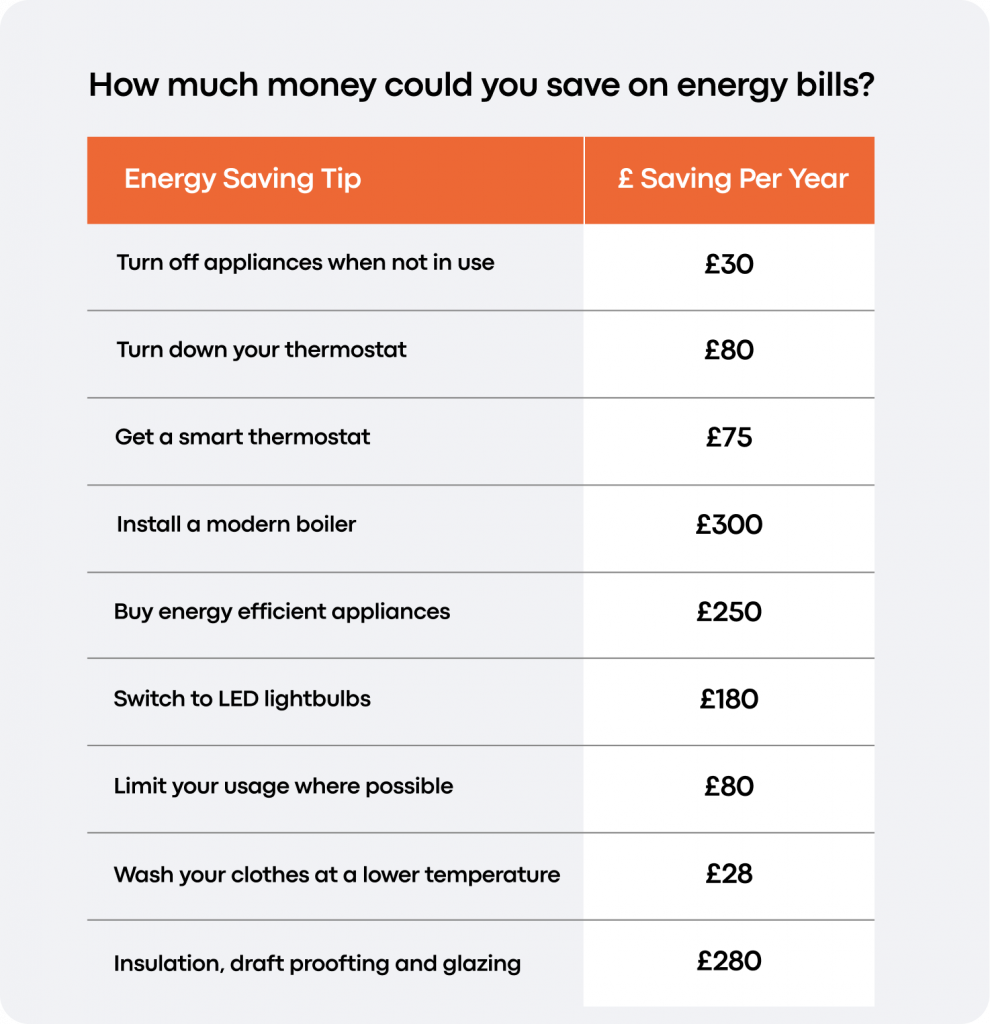

Our energy-saving tips are designed to do just that. From switching off appliances when not in use to getting LED lightbulbs and washing clothes at a lower temperature, here are our top 10 tips for reducing your gas and electric bills.

The average home – containing four occupants – now uses 13 electronic devices such as TVs and laptops. This has massively increased from 1990, when an average of just four appliances were used. Despite this, we still use more or less the same amount of energy as we did two decades ago, highlighting how much more energy-efficient our appliances have become.

Per household, the average gas and electricity bill in the UK is £111.60 per month, or £1,339.20 per year. However, the price cap increase means that energy customers are set to pay an extra £693 a year. This is why saving money on your energy bills is more important than ever.

Our first step for reducing your gas and electric bill requires very little effort on your part. The simple act of turning off appliances at the plug when left on standby mode can save between £30 and £55 a year! There’s no reason not to do this, given that almost all electrical appliances can be turned off at the plug without affecting their programming.

One idea to prevent you from forgetting is to get a standby saver or smart plug that allows you to turn off all appliances on standby in one go. Some smart plugs will even allow you to turn them on and off via your phone.

Did you know that almost half the money spent on energy bills in the UK goes on heating and hot water alone? Turning your heating down by just one degree can save up to £80 a year.

Rather than having to constantly keep an eye on your heating settings, you could take things one step further and get your household a smart thermostat. These make heating more efficient by only warming up rooms that are currently in use.

Smart thermostats can learn how long it takes to heat your home, allowing them to achieve the right temperature exactly when you want. Another useful feature of smart thermostats is that they can usually be controlled through your phone, meaning you can start heating your house when you leave work.

All in all, installing smart thermostats and thermostatic radiator valves can save a further £75 a year.

The best way to make the biggest savings on your energy bill is by upgrading your old boiler to a new A-rated condensing boiler, complete with a programmer, room thermostat and thermostatic radiator controls (as mentioned above).

While replacing an old and inefficient gas boiler with a modern, energy-efficient one will make a big difference to your bill, this won’t come cheap. When factoring in installation, buying a new boiler can end up costing a couple of thousand pounds. This is a long-term investment and not a quick fix. Still, estimates from the Energy Saving Trust show that making this switch in a semi-detached home can save around £300 a year.

While we wouldn’t recommend just going out and buying a load of new appliances – as you’ll end up spending way too much money to make the savings worth it – we would recommend choosing more energy-efficient models when replacing appliances.

Here are a few appliances to look out for:

Across these appliances, you could see yearly savings of almost £300!

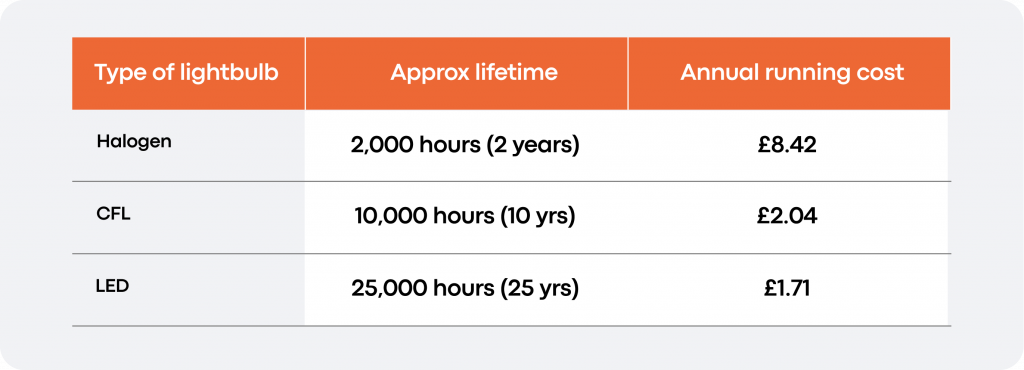

Switching to energy-saving lightbulbs is one of the easiest and most affordable ways to make significant savings on your energy bill. A typical halogen bulb costs £8.42 a year to run and will last for 2,000 hours (around 2 years). On the other hand, an LED bulb costs just £1.71 a year to run and will last for an impressive 25,000 hours (around 25 years).

Depending on the size of your house and the number of bulbs that need swapping over, going with LED alternatives can cut around £180 from your energy bills when compared to halogen and incandescent bulbs.

There are all sorts of avenues you could pursue here. For starters, drying clothes on a rack inside when necessary or outside when the warmer weather hits. This will mean using your tumble dryer less and can knock as much as £55 off your energy bill every year.

By only filling your kettle to the exact water level that’s needed, you can save £11 a year (and make additional savings on your water bill). This is because extra electricity is required to boil a full kettle. Similarly, your dishwasher should only be switched on when it’s packed out. Reducing your dishwasher use by one run per week can save around £14 across a year.

These three simple changes alone already add up to an impressive £80 of savings!

Washing machines use a lot of water and expend plenty of electricity. By using your washing machine on a 30-degree cycle and reducing your washing machine use by one run per week, you can save around £28 a year.

Unless your home is a new-build, you’ll lose a fair amount of heat through draughts around doors and windows, any gaps in the floor, as well as through the chimney. Sealing floor cracks, using draught excluders, lining your letterbox and blocking an unused chimney can reduce your heating bills by up to £35 a year.

When it comes to the insulation process, this can cost several hundred pounds for your loft alone, with an estimated saving of £135 per year in a typical semi-detached house.

Finally, switching from single glazed windows to A-rated double glazing can save as much as £110 a year. This is because double glazing does a brilliant job of insulating your home from the cold, keeping your heating usage down as a result. Altogether, these modifications can save you just shy of £300 a year.

Installing a smart meter in your home will help measure electricity and gas consumption so that your usage can be adjusted in the future. They also send regular usage data to your supplier to continuously monitor and update your billing. If you’ve been making a big effort to reduce your energy bills then having a smart meter will make your suppliers aware of this as quickly as possible. Check out our smart meter article to learn more about smart meters and their benefits.

When it comes to setting up and paying for bills in a rented home, there’s a much easier solution, Resooma Bills bundles all your bills into one easy payment, including utilities (gas and electricity), water, wifi, TV and council tax. If you’re living in a shared home, we then equally split bills between you and your housemates, so there’s no need to worry about any awkward chats or having to chase people up for their share.

Rather than having multiple direct debits leave your bank account each month, you’ll just have one bill to pay, with each housemate being responsible for their share. Setting up and managing bills can feel like a daunting task, which is where our shared bill packages come in useful. Let us handle the stress for you!

All your utility bills in one monthly payment, split between housemates

Get a quote

All your utility bills in one monthly payment, split between housemates

Get a quoteFinding his article helpful? We’ve got plenty more helpful articles on there way. Join our Savvy Sunday mailing list